|

This is a common question that many Arizona home buyers have been asking me! The answer depends on how long you plan to live at your current house. Many times the break-even on the amount of money you spend up front vs. the amount of money you save monthly can be many years. Every scenario is different because sometimes with higher loan amounts in Arizona, the time to recoup the upfront cost of buying down your rate is only a few years. In this example it was over 11 years for it to make sense for this Gilbert homeowner! Watch the video below, and reach out to us if you have questions on your loan, and if you should buy down the rate or not.

1 Comment

As you might imagine, the Tax Cuts and Jobs Act of 2017 created a bit of confusion around the tax-deductibility of mortgage interest in general and home equity lines of credit (HELOC's) in particular. This month’s blog is intended to explain how the Equity Debt Interest Tax changes made by the GOP’s Tax Cuts & Jobs Act, passed late in December 2017, might affect you and your family in 2018 and future years, if you currently have a HELOC on your home, or are considering one in 2019.

The Tax Cuts and Jobs Act of 2017, enacted Dec. 22, suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit, unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan. Under this new law, for example, interest on a home equity loan used to build an addition to an existing home is typically deductible, while interest on the same loan used to pay personal living expenses, such as credit card debts, is not. Borrowers who opened Home Equity Lines of Credit used for debt consolidation will no longer be allowed to write off the interest on their 1098 forms at tax time. However, if you opened a HELOC for home improvement or home purchase, you may still be able to deduct the interest. Debt consolidation refinances or cash out for any reason, if done as a new 1st lien mortgage against a primary or second home residence, still qualifies in full for the mortgage interest tax deduction going forward. Consolidating a 1st & 2nd mortgage into a new 1st lien mortgage will also allow borrowers to continue taking advantage of the mortgage interest deduction allowance. Now with conforming loan limits moving higher in 2019 across the country, refinancing to a new low rate has become even easier. Please let us know if you would like to discuss a year-end review of your mortgage options for the new year. We have seen an unexpected dip in interest rates since early December, and this is shaping up to be a perfect time to lock in a 30-year fixed rate, before they possibly move higher once again in the new year. As brokers, we have the absolute best rates available, with no lender fees and the superior service e you have come to know from us. Happy Holidays! A few weeks ago, I attended the inaugural AIME FUSE conference. AIME stands for the Association of Independent Mortgage Expert’s. I attended this conference to connect with other mortgage brokers across the country and continue to find a better way to serve my clients! The weekend was full of great information and it was amazing to see the energy of the group.

Independent mortgage brokers are thriving. Our lenders that we use compete for our business and this helps give you the best products, pricing and service available. Mortgage brokers provide the best options for their clients. There was some conversation about where the market is. Most people see the market slowing down slightly. This means the rate of appreciation will be going down, not necessarily the prices. An example that was used is right now the economy is like a car. The car is going 80 miles an hour, but if it slows down to 40 miles an hour, is this car still moving? Yes! We look forward to a great rest of the year and are excited about helping more clients finance their dream home!  Hydro girl and Tan Man reminding kids to drink and wear sunscreen! Hydro girl and Tan Man reminding kids to drink and wear sunscreen! Earlier this month, I went up to one of my favorite spots Camp Swift up in Prescott, Arizona! Since I was a high school student, I have volunteered my time with the Swift Youth Foundation. As a high school student, I was able to lead a cabin of 8-12 at-risk youths with other high school co-counselors. Our goal? To give the kids the time of their lives! For many of the kids, they have never left the Greater Phoenix area. I look back at my experience with Camp Swift and the Swift Youth Foundation and see the positive impact that it had on my life. My ability to coach kids and lead groups has come from this organization. As I've progressed in my career, I still feel it is important to support and volunteer with the Swift Youth Foundation. My girlfriend and I ventured up to spend a day with the kids. We arrived the same day that the kids came. They were greeted with loud cheers as they exited the bus. The energy that the counselors and staff bring to Camp Swift is off the charts! We were able to join in the opening skit. I was Tan Man reminding kids to wear sunscreen. We had other staff reminding the kids to drink water and wear toe-closed shoes. If you have a high school student that is looking to get involved in the Swift Youth Foundation, please have them reach out to the Swift Youth Foundation HERE. As some of you may know, Swift Youth Foundation is a Qualifying Charitable Organization as part of the AZ Charitable Tax Credit program (formerly known as the AZ Working Poor Tax Credit). You will receive a dollar for dollar credit off your AZ state tax return (up to $400 for individual filers, $800 for joint filers). To learn more about the tax credit and to donate, please visit www.swiftyouthfoundation.org/taxcredit Are you borrowers worried about not having enough funds for closing? If they do, or if they want to pay for taxes and insurance without an escrow account, we can help! We now offer escrow waivers on conventional loans up to 95% loan to value and 640 credit score! The best part of this? There is NO charge to the borrower. We're always looking for ways to help your clients! Now your borrowers can eliminate some of the up-front costs associated with a mortgage. With borrowers have more money in reserves, we can get loans approved fast and easier!

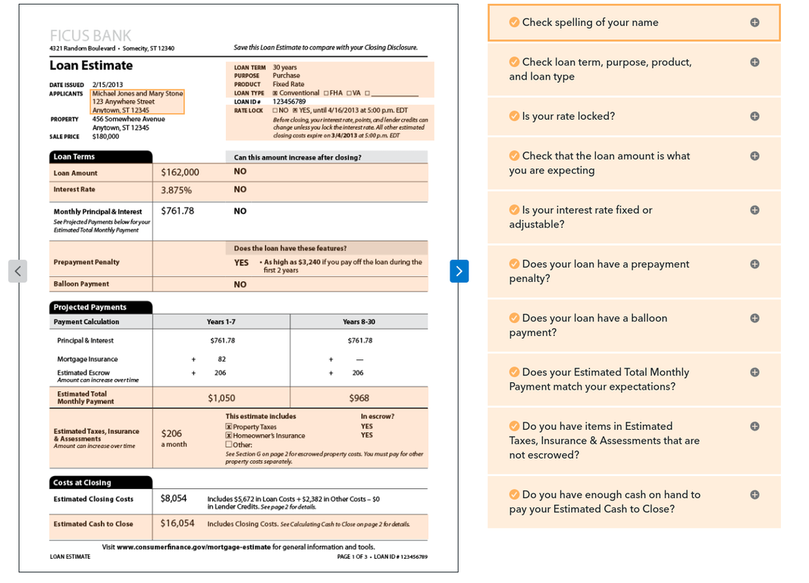

As an Arizona independent mortgage brokerage, we shop for the best wholesale rates available. We save clients money, provide them with great mortgage products, and we are local!  Every summer in Arizona we look to find the ‘coolest’ spots! Located about 3.5 hours away from Phoenix is the Grand Canyon Caverns. At a brisk 62 degrees year round, this cave is a cool escape from the Arizona summer. You enter through an above ground restaurant and walk through a gift shop with Route 66 items and much more. Don’t forget to take a picture on the world’s largest dinosaur saddle! You access the cave by using an old elevator that takes you down 220 feet. If the elevator ever stopped working, there are stairs that were used in buildings in New York as escape routes. Once you arrive to the cave, you walk through a hallway that leads to a large chamber that is lighted beautifully. The Mystery Room in the cave provides natural air. We were led to their underground restaurant called Cafe Grotto. This restaurant was recently established in 2017 and offers a quieter and unique way to eat your meal! It has only 4 tables and offers a view of the chamber and... their hotel! Yes, they have one room that is located in the cave that is used as a guest suite. It has two beds, a tv, and a bathroom. The only catch? The only walls are the walls from the cave! They told us they rent it out most nights, and while I’m not sure I plan to stay there, it would be a one of a kind experience. At the restaurant, you have a server that takes your order and calls (with a wireless phone) upstairs to the main restaurant. The food is brought down by the elevator. While the food is the same 220 feet above, the experience of eating your lunch down in the cave was a memorable one. After lunch we took a tour of the rest of the cave. It has a few other chambers that are larger than the first one you see when you enter the cave. The tour lasted about 30 minutes, and we all thought it was really cool! The tour guides knew all the history of the cave, and it was actually all very interesting. Watch out for the giant prehistoric sloth! All in all, everyone agreed it was a fun afternoon! It’s a great place to bring your kids and you can stop for milkshakes on Route 66 on your way home at the Sno Cap! Fun fact: You can get married down there! There have been 12 weddings in its history. -Evan Grand Canyon Caverns Contact Info: Details: 115 Mile Marker AZ-66, Peach Springs, AZ 86434 (928) 422-3223, gccaverns.com.  A happy first time home buyer with Evan! A happy first time home buyer with Evan! Over the last month, I have had two potential clients give me a loan scenario to price out for them. When I told them the days rate, they both told me that 'the other guy' was quoting them the same rate. I told them that the way Road to Home Mortgage is structured, we should beat almost any other lender out there. The best way to compare fees and pricing is with a Loan Estimate. It is required of lenders to send out a Loan Estimate in 3 business days or less once you have specific information from a borrower (such as their name, income, address, etc). After reviewing my Loan Estimate to 'the other guys', I saved both of these borrowers thousands of dollars. One was over $4200 in just fees, and the other one was over $1700 in fees and $1600 in lower mortgage insurance for the loan. While the rate might look the same, you still might be paying thousands of dollars extra in other fees! Here are some things to look for on your loan estimate:

Below is a screenshot taken from the website mentioned above. You can take 5 minutes to review the details of a loan. It could potentially save you thousands of dollars! Until next time! -Evan Through December 31st, all appraisals will be credited up to $525

Want to save yourself some $? Get a no-cost appraisal! Only our preferred lender provides a credit to your clients up to $525 on ALL CONVENTIONAL loans. We save your hundreds of dollars off, while you still enjoy a great low rate. Coupled with our fast closings,Road to Home Mortgage is the way to go. In addition to saving up to $525 on your appraisal, we give your access to: ● Some of the lowest rates and cheapest mortgage insurance in the country ● Closings in 15 days or less ● Down payment programs with as little as 3% $525 Appraisal Credit with Homeready and Home Posssible! Want to save money on your next Refinance or Purchase? Only Road To Home Mortgage can credit you up to $525 on both Home Possible and HomeReady loans which have an income limit of $69,100. Both programs are great alternatives to FHA and, when coupled with Road To Home Mortgage's better pricing, you may save up to hundreds of dollars off your monthly payment, while still enjoying a great low rate. In addition to saving you up to $525 on your appraisal, HomeReady and Home Possible loans give you access to: Some of the cheapest Borrower Paid Mortgage Insurance in the country Improved pricing to match regular conventional 30-year fixed pricing Down payment programs with as little as 3% Exciting news for all our Arizona borrowers looking to refinance their home! Our wholesale partner has just increased the cash-out maximum from 80% to 85% LTV. This means on a $400,000 home value, you can do a cash-out up to $340,000. You can have more money on hand! This is just another way Road to Home Mortgage is giving you more options on your real estate!

Some of the Program Highlights:

Contact us today if you have any questions! 602-888-7990 At Road to Home Mortgage we are showcasing local businesses around Greater Phoenix. If you haven’t heard of Oven + Vine, you should! It’s a fantastic local restaurant where you can relax and enjoy the delicious food in a remodeled 1940’s Vaughn residence. They also opened a little coffee shop by the restaurant called Birdhaus Coffee. Evan recently spoke with Dylan who is the owner of Oven + Vine with his wife. How did you get started in the restaurant industry? Our restaurant journey began after a weekend trip to a small town in Colorado while we were both in college. We ate at a few places up there and were disappointed in the food. We dropped out of college, moved up to that small town in Colorado, and started The Countryside Coffeehouse. A few years later we made it back to AZ and after one other restaurant venture we started our current restaurant Oven + Vine. How do you maintain the neighborhood feel to your restaurant? We try to keep Oven + Vine casual as we don’t have uniforms or a hostess. We want our customers to come in and feel as though they are eating at a friends house. Our prices are affordable and this allows our customers to come visit us more often. We have some customers visiting us 3+ times a week! What’s your favorite dish in your restaurant? The green chile pork is hands down my favorite. My wife grew up in New Mexico and as a teenager, she learned how to make some awesome green chile pork. In our restaurant we slow roast our pork and marinate it in green chile. Do you have any favorite local restaurants in town? We are big fans of St. Francis and Richardsons. I also remember going to Pizzeria Bianco before the 3 hour waits existed! You serve a wide array of wine. How do you choose which wine to offer? We have 8-9 wine companies visit our restaurant every week! Many times the winemakers and owners come share their knowledge of wine with us. We usually try 20-30 wines a week. We always try to find wine that taste great, but that is also affordable. This is a family business. How is it to work with your family? The best way I can describe it is unique! Most people think you can’t work with your wife and family. We have made it work great, and we enjoy spending the extra time together! You recently opened Birdhaus coffee bar which also serves fresh waffles. What do you like on your waffles? I’m a simple guy when it comes to my waffles! I like my waffles with the organic maple syrup that we have at Birdhaus. What’s your most popular dish?

People are in love with our flatbread! Right now our most popular one is the sausage and mushroom flatbread. If this interview got you hungry, go check them out! We love showcasing local businesses! If you would like to be featured on our site, please let us know! Info@rthmortgage.com Oven + Vine: http://ovenandvine.com 14 W Vernon Ave, Phoenix, AZ 85003 Birdhaus Coffee: http://birdhauscoffee.com |

THE Road to Home TeamThere is a lot to learn about mortgages and real estate. We are here to help! Check out our blog posts! Archives

March 2024

Categories |

RSS Feed

RSS Feed